Our EFTPS Federal Tax System Login Guide will explain all the steps involved in the Electronic Federal Tax Payment System login process. As a brief description, the Federal Tax Payment System login portal is part of the tax paying online services provided by the United States Department of the Treasury. In other words, it is one of the key government online services for citizens to pay their taxes. Through the Federal Tax Payment online service, you can pay your federal tax online, enroll for EFTPS portal online sign in credentials, browse the frequently asked questions related to the process, and get in touch with a customer service representative for additional Electronic Federal Tax Payment System login assistance. You can find full instructions for the entire process below.

EFTPS Federal Tax System Login to Make Payments

The main reason why citizens use the EFTPS Federal Tax System login portal is to pay their taxes. To do so, you need to be enrolled as a business, individual or federal agency and have an EIN or SSN, a PIN and an internet password. If you are interested in enrollment, please consult the third section of our guide. In addition to these pieces of personal information, you will naturally need to have access to a computer with a reliable connection to the internet to reach the Electronic Federal Tax Payment System login page.

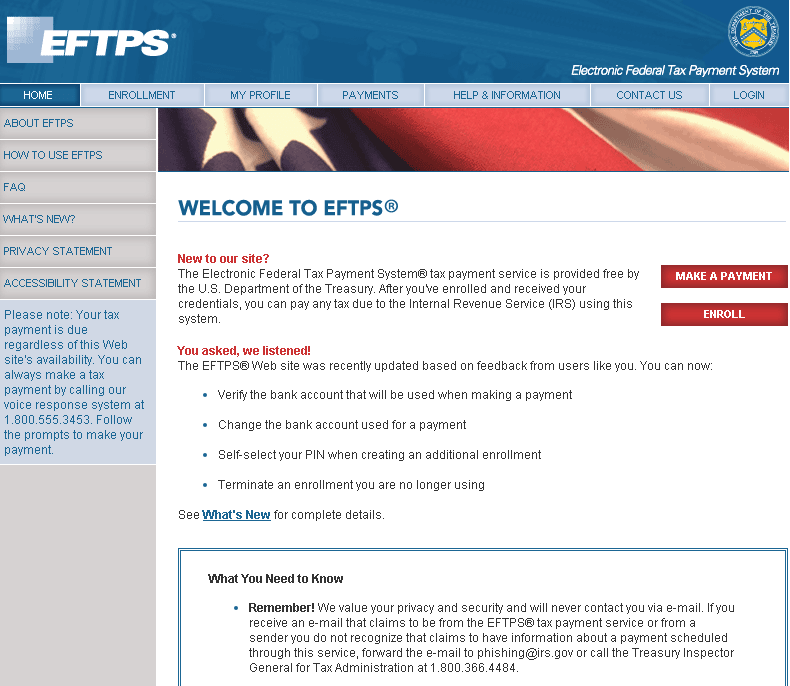

This is how the EFTPS Federal Tax System login page should look like.

If you have all your information prepared, you may proceed with the EFTPS Federal Tax System login instructions described here:

- Connect to the official Electronic Federal Tax Payment System login portal at eftps.gov. The website you reach should look like the image we have provided, otherwise you might have accessed the wrong page. The best way to gain successful access is to click the link inserted above.

- On the EFTPS Federal Tax System login page, please press the red button that reads Make a Payment.

- If you are paying taxes for your business, enter your Employer Identification Number (EIN) in the first two empty fields. Individuals have to enter their Social Security Number (SSN) in the three boxes provided for this purpose.

- Proceed by typing in your Personal Identification Number (PIN) and your Internet Password. Users who need to set their password are invited to consult the second section of this guide for detailed assistance.

- After checking your personal information for accuracy, press the blue Login link at the bottom right-hand corner of the Electronic Federal Tax Payment System login box.

- If your details were typed in correctly, you should now be able to pay your taxes through the EFTPS Federal Tax System login portal.

How to Set Password for Electronic Federal Tax Payment System Login

Users who want to set a password for Electronic Federal Tax Payment System login can do so in several minutes. Please note that you will require your EIN or SSN and PIN to complete this task, as well as your verification information.

- Go to the EFTPS Federal Tax System login portal at eftps.gov.

- Push the red Make a Payment button on the home page.

- At the last line of the Electronic Federal Tax Payment System login box you will see a blue link that reads Need a Password. Please click it.

- Enter either your Employer Identification Number (EIN) or Social Security Number (SSN), depending on your status as a Business or Individual.

- Type in your Personal Identification Number (PIN).

- Provide your Verification Information. You can choose your banking information or your enrollment number as a method for verifying your account. If you choose Banking Information, enter your Routing number and Account number. You will need to provide your account number Those who choose their enrollment number need to enter only the last eight digits.

- You can press Clear form at any time to re-enter your information. If you are done, press the blue Next

- Set your password and complete the process.

- Go back to the EFTPS Federal Tax System login page to access your account and pay your taxes online.

Electronic Federal Tax Payment System EFTPS Enrollment

Enrollment for EFTPS Federal Tax System login can be achieved in four main steps: Start, Enroll, Review, and Complete. We have detailed each step below for your convenience.

- Access the Electronic Federal Tax Payment System login portal by clicking this link: eftps.gov.

- Press the red button entitled Enroll on the home page.

- Read the Privacy Act and Paperwork Reduction Act and, if you accept, check the small box confirming that you agree with the terms.

- Choose the way you want to be enrolled: as a Business, Individual, or Federal Agency.

- Enter your Primary taxpayer Social Security Number, the one registered with the IRS. If you cannot remember your SSN, you can call 1-800-772-1213 to get in touch with the Social Security Administration.

- Type in the Primary taxpayer name, just as it shows on your Social Security card.

- Enter your phone number or the number of the primary taxpayer. If the phone number is international, provide it in the field directly under the first one mentioned.

- To Add joint filer information, you will need the name and the Social Security Number of the joint filer. If this step doesn’t apply to your situation, you can skip it.

- Provide your Contact information, including your name, country, address, city, state, ZIP code, and phone number.

- Continue with your Financial information. Type in your routing number, your account number (twice for confirmation), and the type of account you have (Checking or Savings).

- Press the blue Review button and follow the rest of the steps that appear on your screen to complete the process.

Assistance for EFTPS Portal Online Login

If you have any extra problems with your EFTPS Federal Tax System login, you can always consult the Help and Information Center provided by the U.S. Department of the Treasury on this website. After you connect to their home page, select the Help & Information tab from the main menu at the top of the screen.

Depending on what issue you have, explore the following categories:

- Introduction

- About EFTPS

- Security

- Disclosure/Privacy Statement

- Accessibility Statement

- Terms and Conditions

- FAQ

- Glossary

- Downloads

- Links

- How To

You will most likely find an answer to your inquiries in the FAQ section. Browse through the general, login, payment, information, and enrollment questions to see if you can find a solution.

Contact a Federal Electronic Tax Payment System Representative

If you didn’t find the answer to your problem in the Frequently Asked Questions section, you can personally reach out to a representative for Electronic Federal Tax Payment System login help.

There are two main ways in which you can contact an EFTPS agent: telephone and email.

For payments via telephone, please call 1-800-555-3453. English speakers who want to get in touch with a customer service agent can call 1-800-555-4477, while Spanish speakers can dial 1-800-244-4829. Citizens who are currently abroad can call 1-303-967-5916. Businesses can get assistance from Monday until Friday, from 7 in the morning until 7 in the evening, at 1-800-829-4933.

Residents who prefer written communication can send an email to sbse.eftps@irs.gov. For any other information, please access the official Electronic Federal Tax Payment System website at www.eftps.gov.

Leave a Reply